Budget Analysis - Part 1

Last updated: May 11, 2023

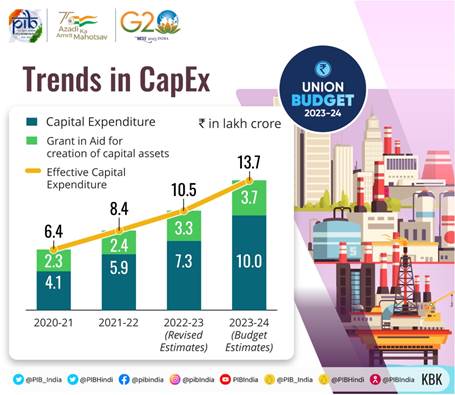

Consider the Figure 1. It is an infographic taken from the Budget website. Here we see BE for FY24 :

Revenue Receipt = ₹ 26 LC , Capital Receipt = ₹ 19 LC

∴ Total Receipt = ₹ 45 LC

Revenue Expdt. = ₹ 35 LC , Capital Expdt. = ₹ 10 LC

∴ Total Expdt. = ₹ 45 LC

So Receipts and expenditure match.

Few important points to note :

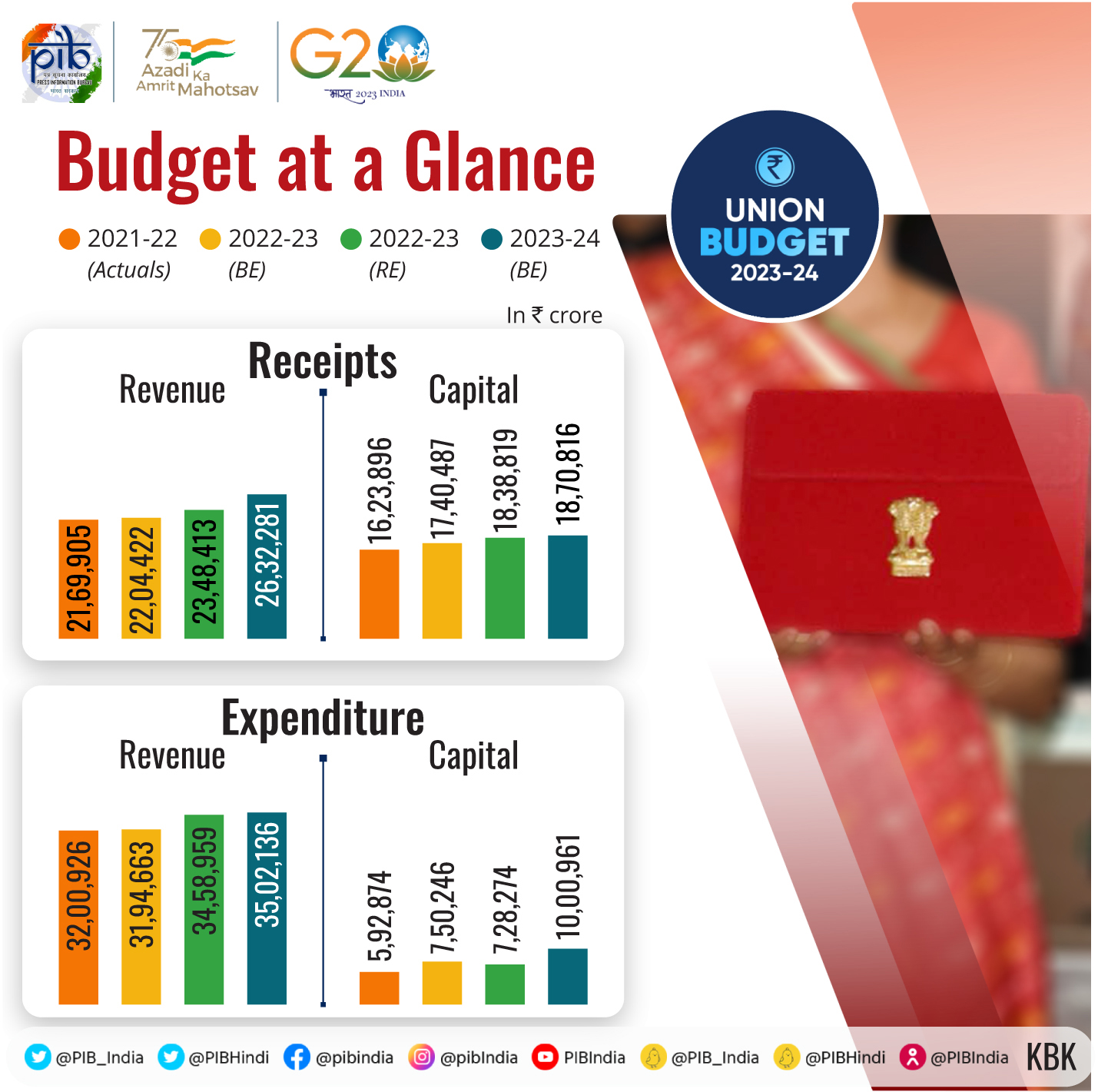

Nearly the entire ₹ 19 LC Capital Receipt is “Debt”. And nearly this entire debt is Internal Debt. The Internal Debt is mainly composed of Small Savings followed by Market borrowings. The Debt components with their trend is shown in the infographic of Fig 2.

All of these figures are in line with my discussion in this article.

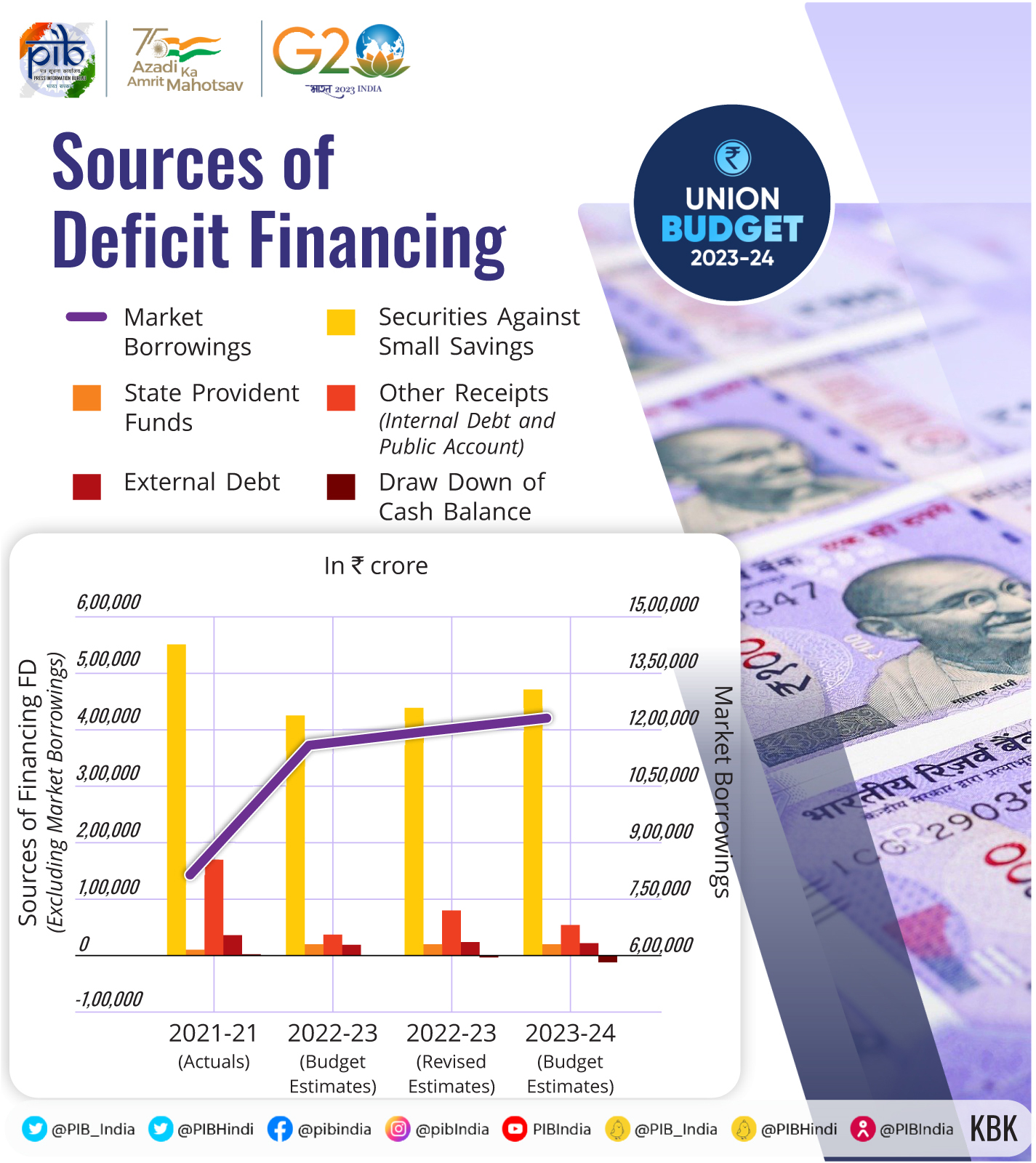

The trends in Receipts & Expenditures can be seen in Fig 3 from the Budget Highlights

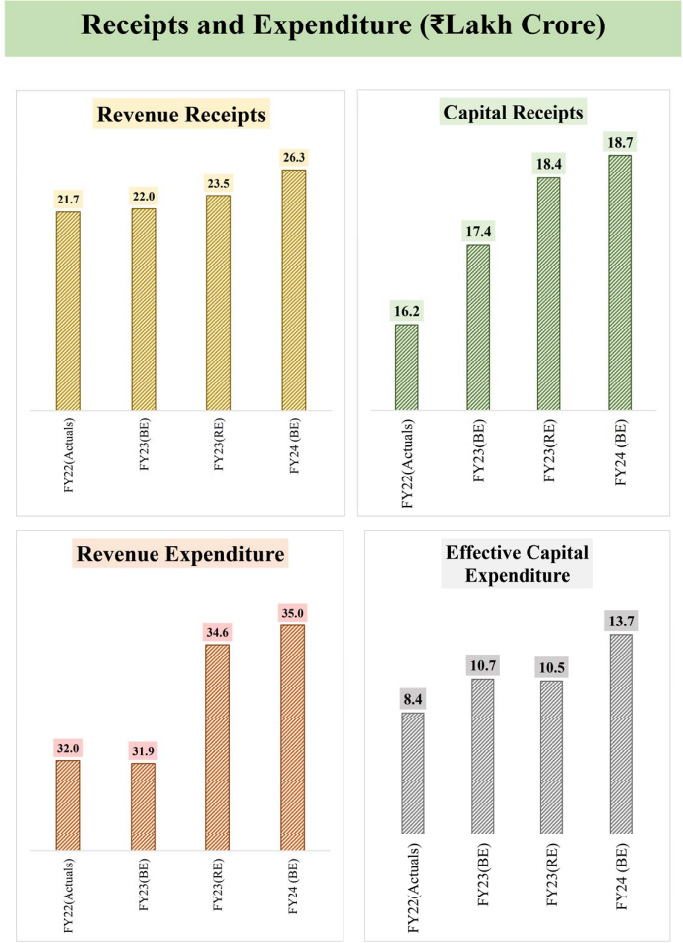

Figure 4 shows the steady rise in Capex over the last few years, taken from PIB. This is good for the economy. CapEx is mainly done by ministries such as Defence, Railways & Highways.