Accounts Tidbits

Last updated: Mar 9, 2021Expdt.

This is mentioned in Sec IV of WBFR (Rules 34-38)...Rule 34 (Essential conditions governing expenditure from public funds)... there should be allotment + sanction as per DFPR 1977 amd.by 4411-FY

Rule 35 (Standards of fin. propriety)... (5 points : vigilance/prudence, occassion, & No adv. of benefactor, beneficiary or specific sections)

Rules 36 & 37 (Control of expdt.) ... Each HoD/Contr.officer must maintain economy in expdt.& also check if its spent for ordained purpose

Losses

Rule 39 (Report of losses) ... Any loss to be reported to imm.superior officer + to AG (even if loss is recovered)Rule 41 (Report of accidents) .. to be reported by officer to HoD & by HoD to govt. After full enquiry, officer to send detailed report to HoD + AG

Rule 42 (Responsibility of losses) .. officer personally liable for any losses sustained by govt. through his fraud or negligence.

Handover/Transfer of charge

Rule 61 To be reported to AG on same dayRule 62 Cash book/Imprest cbalance checked & closed, any anamoly to be reported

Splitting of works

Prohibited as per Rule 102 WBFR.Also 4609-FY prohibits it except for exigencies only after express approval of adm.dept.

284-FY mandates approval of FinDept before releasing payt of works where splitting is suspected.

General principles before entering into a contract/agreement

Ref. Rule 47 of WBFR,11 points : Precise terms, Take legal/fin. advice, Std formats, Uncertain liability needs findept approval, LD clause, Revocation clause on 6mth notice, Avoid cost+, Written, SD, Tendering (publication slabs given), Minm period to submit bids(slabs given)

As per Rule 47(8), only open tenders/quotations should be done. An exception to it is Rule 47(14) (as expanded vide 1956-fy) whereby LTIs/Single-tenders are allowed for urgency/proprietary cases after approval of Adm & Fin. Depts.

New Purchase policy

As per GO no. 5400-FY amended by GO 6932FYFor estimated value of goods or services is < Rs 10k .... no tender reqd (no ad reqd)

10k-1lac ...Quotation from 4 reliable firms (ad in notice board+ dept.website)

1 lac-5 lac .... open tender (ad : + one Bengali daily newspaper)

> 5 lac (twas 50 lac in 5400fy but made 5 lac vide 6932fy) ... e tender: (i) 5lac-10 lac : (ad : + English newspaper + etender portal of GoWB) (ii) > 10 lac : (ad : + Hindi newspaper + GoWB website)

(NB. All newspaper ads are brief referral ads, ie. only basic info present)

(Nb. Publication slabs originally given in Rule 47)

Minm period to be given to bidders to bid (as per Rule 47) :

< Rs 10 lac : 7 days

Rs 10 lac-1 cr : 14 days

> Rs 1 cr : 21 days

Additional Performance Security when the bid rate is 80% or less of the Estimate put to tender and no increase in scope of work of projects during execution phase as per FD Memo No. 4608-F(Y)

2-bid system : mandatory for tenders > Rs 10 lac

4 objectives of tenders : TCEA (transparency, competition, Economy, Accountabiity)

Contingency component (max 3% of awarded value (not tender value) allowed as per GO 6427 FY) is the extra expdt during execution of work

2 types of committes in every office : Tender Committe (for finalizing tenders) & Local Purchase Committee (for finalizing quotations)

(nb. Each Dept. in WB should also have specialized tender committes vide memo 5965FY to scrutinize tenders (not finalize tenders!)

As per Memo no. 9754-F(Y) dt. 3.12.12, all offices should have a Tender Register

Forward auction : Buyers compete (price inflated) ; Reverse auction (~tender) : Sellers compete (price deflated)

GeM :

In 2017, commerce min of India shut down the govt. procurement arm DGS&D. Then vide 3876-FY, GoWB estd GeM as per which :Primary user : registers the org on gem portal

Secondary users : assigned various roles (they're buyers, consignees & bill-payers/DDOs) [3 works : placement of contract, receipt of stores ie consignee, payt. to sellers]

(each division of the org. should have its own secondary users, eg. all block offices within a district)

4949-fy spells out the org hierarchy in GeM : the 4 types of state govt. orgs., the primary user in each case, division of an org into divisions each having a sec user. Each primary user must be approved by a 'verifying authority'. Primary user can't be below dist. level (ie DM, CMOH, etc)

As per memo 5430fy & 4262fy for GeM : Up to Rs. 25,000/- (twas 10k in 5430 but made 25k vide 4262 fy): direct purchase from any of the available suppliers on the GeM. Above Rs. 25,000/- and up to Rs. 1 lakh through the GeM, Seller having lowest price amongst at least three available sellers Above Rs. 1 lakh through the supplier having lowest price after mandatorily obtaining online bids/rev auction

if 2 bids only are rxed...online reverse auction in gem is reqd (since then sellers themselves approach buyer & underbid each other, so lower bids will ensure price quoted is reasonable) if 1 bid... possible as per GO 6989-FY & 925FY if branded product/single source purchsae , give explanation (mostly urgency) as per WBFR 47(14) modified by GO 1956-FY....prior approval of Dept.Secretary/Dept.Fin.Advisor & Group 'T' of Fin.Dept. reqd.

vendor should get payt within 10 days of generation of CRAC by consignee

WTL.... 1782FY allowed govt.depts. to purchase IT products without WTL's assistance & 4370fy went further & allowed purchase from WTL iff GeM doesn't have that product.

### Cash book Maintained as per 12155-F. Don't confuse with case-book which head clerks keep for file entry in office.

Austerity/Economy measures

General economy measures as per 4201-fp dt 2018. For Covid, addl austerity as per 1971-fySteps to incur project-related expenditure

Ref 5400 fy...Agency deployed by a dept will do these works: prep of DPR & also estimate prep therein(if), tendering, work implementation...Agency fee for each of these 3 tasks as a % of estimated cost is given in 5400 fy..Agency..experts..only for big work..allowable agencies given in 5400 fy annexureA project is a task by an adm dept. One project may have multiple HOAs

as per 2131-fy, Process of expdt. : Jt. secr of dept uploads project details in aafs module of ifms (unique project id generated)...fa of dept approves it...if within dfpr power of dept then passed, else sent to fin. dept for FS (nb for a project above Rs 5 cr,technical vetting by fin dept is reqd as per 5400 fy..After AA&FS done in IFMS, then release of fund in resp HoA by FinDept through e-bantan .. project done..bill paid by DDOs

Nb. A technical project may require tech. sanction from resp engg dept.

nb. Basic estimate...Adm approval...detailed cost estimate and drawings..Technical sanction from engg dept

Reappropriation

Online reappr system through ebantan introduced vide 50-fb dt 2018. Approval of first dept Fin advisor (FA) & then dept ACS is reqd in ebantan for reappr. Refer "Budget" chapter of WBFR for more details.Budget

Receipts...Annual Finance Bill/ActExpdt... Annual Financial Statements (its 'made' expenses are voted as DfG)...then Appropriation Bill/Act

Charged & Voted Expdt. :

U/As 112 & 203 Const., Charged exp => discussed but not voted. Voted exp=> presented as DfG & voted. 'c' or 'v' in Major head signifies this.Revenue & Capital Expenditure

- General principles for allocation of expenditure between Revenue & Capital heads :Capex permanent assets or reduces recurring liabilities...grant-in-aid is revex...capex-cap receipts & revex-rev receipts linkage should be maintained in budget afap...Give egs. Also ref. Memo 581-FB wherein govt. declared certain revex associated with cap. schemes as capex : site prep, proff fees, initial costs, installation, intermediate maint. costs

Main principles governing allocation of expenditure on a capital scheme between capital and revenue accounts

As per GOVERNMENT ACCOUNTING RULES, 1990 :(a) Capital account should bear all charges for the first construction and equipment

(b) revenue account should bear all subsequent charges for maintenance

(c) Renewals/replacement goes from rev a/c whilst Genuine improvements go from cap a/c.

(d) Expenditure on account of reparation of damage caused by extraordinary calamities such as flood, fire, earthquake, enemy action, should be charged to Capital account or to Revenue account or divided between them in such a way as may be determined by Government according to the circumstance of each case.

(e) Capital receipts in a project (eg world bank loan) should go for capex, uless a govt GO.

Structure of govt. accounts

Consolidated Fund (Art 266(1)) ... has 3 divs - Revenue, Capital & DebtPublic Account (Art 266(2)) .. where govt. acts as a banker . Includes 6 A/Cs – Provident fund & Small savings, Deposit and advances, Cash Remittance, Suspense, Reserve fund, Cash balance

Contingency Fund (Art 267)...to meet unforseen expdt pending approval of parliam/legislature

Suspense heads accommodate temporarily, transactions which can not be taken in to final heads. It contains transactions which are ultimately removed either by recovery in cash/payt/book adjustment. Also all interstate transactions take place through suspense accounts. Suspense a/c is a part of public a/c.

NB. Vide 1881-FB dt. 2018, GoWB did away with Plan/Non-plan expdt.

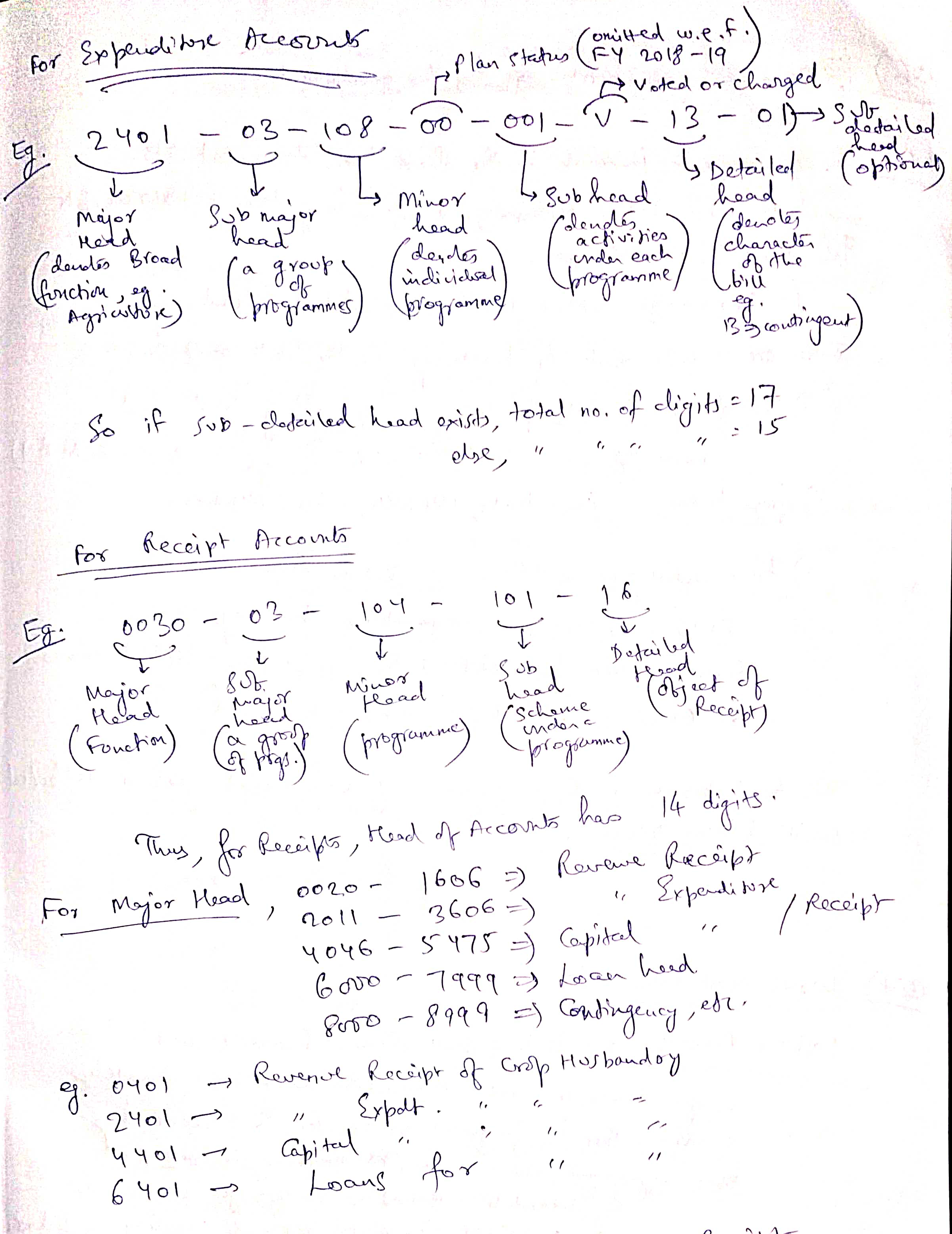

Head of Accounts

art 150..cag advices presi to release form of account-keeping for union and states...Accordingly,Codification done not based on dept of expdt/receipt, but on the basis of function/programme,etc (mukherjee commission reco)....In both expdt & receipt HoA, the imp. heads are **Major**, Sub-major, **Minor**, Sub-head/Scheme head, **Detailed head**.

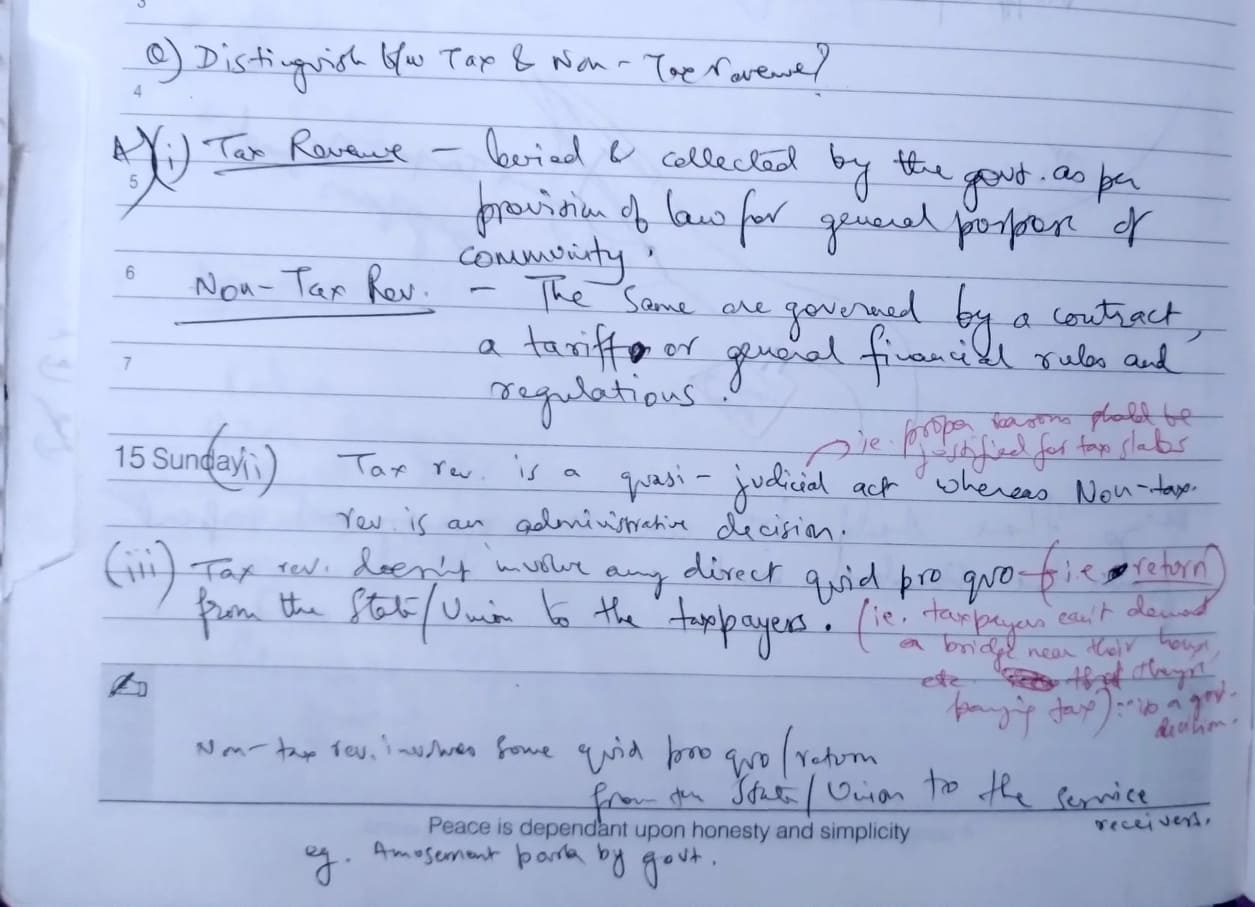

Tax and non-tax revenue

Principles of classification of financial transactions of the government

Write about structure of govt accounts, HoAs, rev and cap heads, etcAlso eg. is 0049- interest receipts, 2059- public works

State borrowings and Ways & Means Advances

3 types of state borrowings : from mkt (OMOs), from institutions (eg nabard, wb), from RBI (WMA, overdraft, sdl, etc)In terms of Article 292 & 293 of the Constitution of India, the union & state resp. can raise money by borrowing, upon the security of the resp. Consolidated Fund.

WMA is short-term loan given by RBI to GoI/GoState @ Repo rate to meet short-term diff bw receipts & expdt.... (beneficial for govt since mkt borrowing (through selling g-secs/bonds in Open mkt) is usually 2-3 % above repo & limited to 3% of gsdp)

Also every Tuesday RBI does SDL (special dev loans) auctions for state govt @ high interest rates & on fridays for GoI

Special WMA/Special Drawing facility (upto ~300 cr)... then Normal WMA (~ 3000 cr limit in covid era)... then overdraft @ repo+5%...if 14 days overdraft, then freezing of state govt banking transactions

WMA is usually used when state govt treasury balance of consol fund goes to -ve...rbi publishes this balance for all states every morning.

Financial committees

As per Art 118 for Parliam. & art 208 of Const. for state leg., every house can make its own 'RoP(Rules of Procedure)'. Under these rules various Standing & ad-hoc committes were made. 3 imp. standing committees are Estimates comm, PAC & Comm on pub. u/ts. PAC - CAG audits govt's appropriation A/Cs. And PAC scrutinizes CAG's report. So re-does CAG's work ! Essentially, it checks whether funds alloted/reappr. by concerned House are utilized by Executive under proper heads. Thus its a post-mortem analysis & a legislative check on the Executive. Estimates Comm - It suggests improvements (esp.economizing ones) in 'estimates of expdt.' ie. in Appr.Act/Budget after its voted in the house (∴ post-mortem). Comm on public U/Ts - does work of both PAC & Est.comm. but for selected public undertakings every year.Audits

General principles of govt. audit :1. Verifying the competetncy of sanctioning authority

2. to understand the system of account followed

3. to check as far as possible the accuracy of the original record, namely, the cash book.

4. to see that all transactions are in accordance with the minutes of the meetings of the Board of Directors or the orders of competent authorities.

5. to investigate unusual items.

6. to check the compilation of the accounts from the original record and to suggest corrections in the classification of transactions.

7. to review the procedure of stock taking and of pricing the goods in hand.

8. to check the financial results, that is the Manufacturing, Trading and Profit and Loss Accounts, and the Balance Sheet, which will indicate accurately the progressive position of affairs. This necessitates also the investigation of depreciation of property (building, machinery, furniture etc.) the soundless of investments, debts due to the firm and the correct allocation of expenditure to Capital Account.

9. Also to check allotment, sanction, fin propriety, etc

Audit process.... Auditing..Audit queries on the spot...Audit replies on the spot...Else Audit paras sent later in IR (Inspection Report)...Broadsheet replies to those paras..Else unreplied paras become CAG paras (after passing through Draft Para stage) & presented to Parliam.

CAG Audit... it has 3 parts - (a) Regularity Audit, (b) Propriety Audit and (c) Efficiency cum-Performance Audit.

Audit of Public Debt ... An important duty of Audit in relation to borrowings is to see that the proceeds of loans are properly brought to account and that they are expended only on objects for which the loans were originally raised

Audit of Receipts... incl. auditing receipts of customs, forest,etc. depts...whether receipts are regular & correct assessed amt & collection system is strong

Audit of Expenditure .... nb. Three principal processes involved in payment of money on Govt accounts (apart from allotment & sanction order) are

1.Submission of claim

2.Disbursement of the money claimed

3.Incorporation of the transactions in accounts

Audit of sanction is where auditors SCRUTINIZE the SANCTION ORDER & every details therein (including whether the sanction was propoer as per dfpr devolved powers of Presi u/a 77(3) or Governor u/a 166(3)) (also incl timeline of sanction, whether even one item in the work is not without appr sanction, etc).

Audit of Appropriation... = Sanction audit + Expdt audit. Audit of appr is done annually by CAG for each state and involves checking if excess expdt in a grant has been regularized through suppl appr act in state leg.(as per art 205 of const.), and also if deficient expdt under a grant/dept (ie savings) has been surrendered by that dept to finance dept by 14th feb or not (as per WBBM). Also proper HoAs maintained or not, and other points of expdt audit

Audit of Contingent expenditure... gen. expdt. points + for specific cont. expdt. types + UC + ePradan will show if money imm. rxed by vendor

Central Audit ... confined to the offices of the AG (Audit) located in the different States..done by central audit party..they check the diff schedules,vouchers,etc sent to ag office by diff treasuries & also various sanction orders & processes followed in ag office. It is largely a regularity and propriety audit.

Local audit (of treasuries by AG) may be distinguished from inspection in that its purpose is to audit the initial accounts maintained in certain Government offices on the spot. Here the duties of audit are not confined merely to seeing whether the initial accounts are maintained in proper form or whether the financial rules are properly observed but a test audit of accounts is conducted in sufficient detail to verify the accuracy and completeness of accounts according to the prescribed rules.

Transactions with other govts

AG of State 1... Central Accounts Section of the Reserve Bank, Nagpur (Suspense head) .... AG of State 2 or CentreEgs. Loan by centre to state, repayt of loan+interest by state to centre, etc

TR Forms under Part 3 of Rules

After IFMS, all forms under part 3 of WBTR are mofified vide 965-FY. Mandatory e-billing TR forms have been introduced vide 6295-FY, eg :- TR 68 : for WBHS reimb/adv.TR 21 : TA/DA/LTC

TR 24 : Medical Reimb Bills (except wbhs)

TR 27 : Bill for drawing advance without supporting Voucher

TR 28 : Detailed bill for adjustment of advance of tr 27

TR 34 : Bills for 'refund of revenue'

etc. - Essential condns for making expdt from cons fund

Chap.4 : Withdrawl from govt. accounts

4.004 : Purposes for which TO may permit withdrawl from treasury-linked bank4.005 : For purposes other than 4.004, relevant GO should be attached by DDO alongwith bill

4.007 : A TO may decline an improper claim under this rule

4.008 : A TO may return/cancel a doubtful claim. He may also send claim to DTA,WB in case of doubt.

4.021 : Claims to be presented by DDO alongwith bill register & bill transit register (now they're incl. within IFMS itself..DDO can upload them on IFMS using his DSC loaded dongle)

4.024 : DDO should draw claim immly (within 1 yr of bill's due).. Therefter

4.111 : Classification of contingent charges : Contract, Scale reg, Special, Countersigned, Fully-vouched (Also ref Chap 4 of WBFR for Contingencies, Advances & Perm Advances) (nb. Contingent expdt is incidental expense for mgt of office)

| Bill pending for | Sanctioning Authority|

| --------------- | --------------- |

| 1-3 yrs | HoO |

| 3-6 yrs | HoD of current dept |

| > 6 yrs | Cadre contr. dept |

Chap.8 : Responsibility for withdrawl from govt. accounts

Rule 8.09 : A bill has 2 fates: either stamped "paid" on it (ie. it becomes a voucher ie. a proof of payt.), or Cancel it (To prevent its re-use). NB. Bill contains account of works done/goods supplied..whilst many sub-vouchers may be part of a bill..sub-vouchers are given by vendor directly &Rule 8.11 : All sub-vouchers(~quotations by vendors) must be cancelled

Rule 8.12 : The primary resp. of Overcharge is of the DDO, but in culpable negligence TO/Contr.officer may have some liability

Rule 8.13 : If officer rxes any orders/audit objections from AG, he should reply within 14 days

Functions entrusted with the Treasury ... It rxes money due to govt offices & pays claims made to govt.(via DDO). Also : presents A/Cs to AG, banker of panchayat funds, strong room.

Checks to be applied in the Treasury in case of payment... Bill in proper TR form, DDO sign present, proper math, allotment, sanction, Head of account, no erasures, subvouchers needed for bills>Rs 500/- , Schedule of recoveries (eg tds, p tx) are properly deducted & by-transfered into correct HoA

Monthly accounts to be submitted by TO to AG (& onward compilation/consolidation)... Ref TR 2.35 ...1st schedule of payts.(only expdt. no receipts)(by 12th day) & Secondary List of payts, Cash account( ie receipts) & Supporting schedule with challans/vouchers (by 5th working day) sent by TO to AG (alongwith all vouchers(ie paid bills) & subvouchers..so treasury becomes empty of papers:))....Then its compiled for all tresuries by AG...AG sends to CGA,India & FinDept,GoWB...then compiled for all states by CGA...Then CGA sends it to the Budget division of MoF,GoI & also to RBI, Nagpur (for reconciliation)

Relation bw audit & finance depts of govt. Both have same objectives ie Eff & propriety of govt finance AND safeguarding public money

FinDept makes rules/Forms (Pre-mortem) & Audit checks whether those rules/forms are followed (Post-Mortem). AG sends a copy of its report to FinDept(Audit section). FinDept consults AG before making rules/budget...so a cyclical relationship.

Daily and monthly closing of treasury

Ref TR 2.33 & 2.35. Also ref 11.11 & 11.12 of Audit & Accounts Book.Inspection of Treasury... TR 2.07 & Appendix 4... Inspection done by Collector-in-charge/collector(annually) (submits to Div.Comm. through Collector), DivComm. further submits to DTA,WB & AG(A&E),WB & FinDept. (Internal Audit section).DivComm. further submits to DTA,WB & AG(A&E),WB & FinDept. (Internal Audit section). T.O. (submits to Div.Comm. through Collector), Collector (submits to DivComm.)DivComm. further submits to DTA,WB & AG(A&E),WB & FinDept. (Internal Audit section).

& FinDept. (Internal Audit section) (during their Audit).

& DTA (biennalyy)(submits further to FinDept)

Also ref 11.20 & esp Chap 18 of Accounts book